🏡 Introducing the Rental Property Investment Calculator

Investing in rental properties can be an incredibly lucrative strategy for building wealth over time. However, to ensure that you’re making a smart investment, it’s crucial to understand not just the potential rental income, but also the underlying costs, financing, and long-term returns. This Rental Property Investment Calculator was designed to help investors like you analyze and evaluate the financial performance of a rental property before you make the leap.

📊 What Does the Calculator Do?

This calculator allows you to input key details about the property and your financing plan. Based on this information, it calculates the following:

-

💳 Monthly Mortgage Payment:

Calculates your monthly loan payment based on the loan amount, interest rate, and loan term. This is crucial for understanding your ongoing financial commitment. -

💰 Monthly Cash Flow:

This shows the amount of money you can expect to receive after all expenses, including mortgage payments, maintenance, taxes, insurance, utilities, and more. It helps you determine if the property will generate positive or negative cash flow each month. -

📈 Annual Return on Investment (ROI):

The ROI shows how well your investment is performing over a year. It’s an essential metric for determining whether the property is worth the capital you’ve invested. -

🏦 Capitalization Rate (Cap Rate):

The Cap Rate measures the property’s income-generating ability in relation to its value. It gives you a quick way to compare potential investments and evaluate risk. -

📉 Total Monthly Expenses:

This includes all costs associated with owning and maintaining the property, such as the mortgage, taxes, insurance, utilities, and maintenance. Understanding these costs is key to making an informed investment.

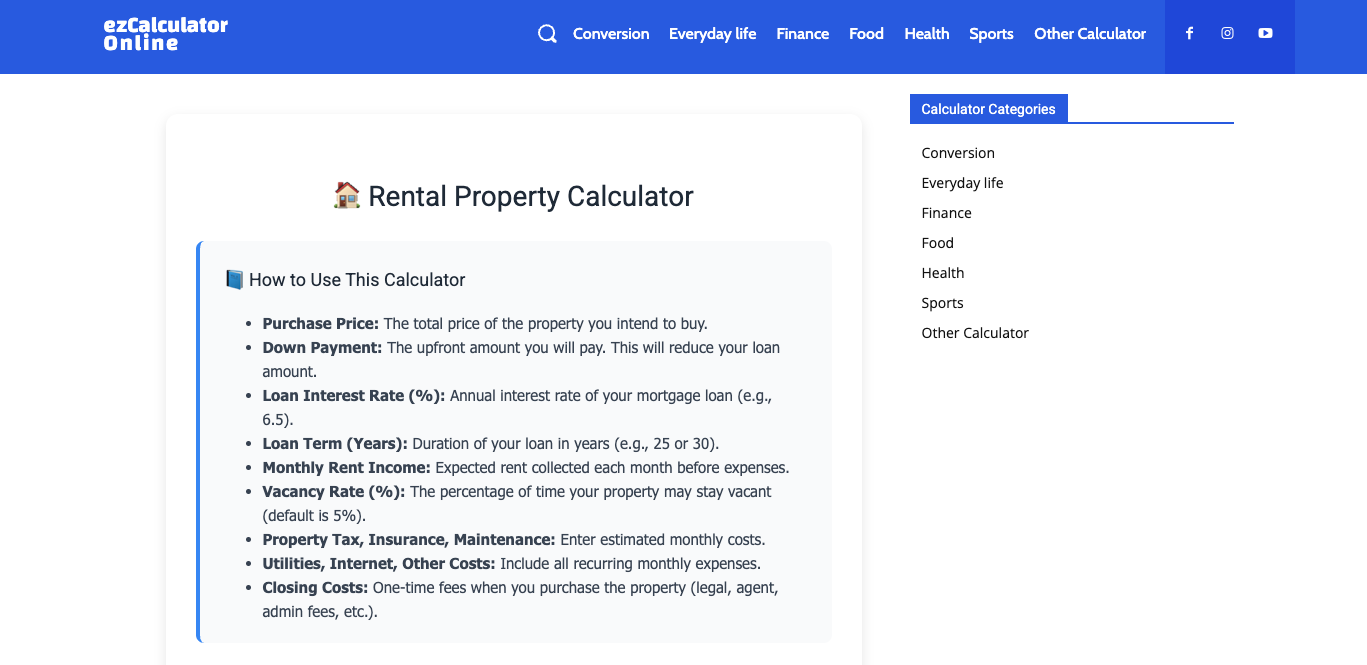

🔢 How to Use the Rental Property Calculator?

To get accurate results, simply input the following details about the property you’re considering:

-

Purchase Price: The total cost of the property.

-

Down Payment: The initial amount you’re willing to pay upfront.

-

Loan Interest Rate: The annual interest rate of your mortgage loan.

-

Loan Term (Years): The duration of the mortgage (typically 15, 20, or 30 years).

-

Monthly Rent Income: Your expected rental income, before expenses.

-

Vacancy Rate: The percentage of time the property may remain unoccupied each year (default is 5%).

-

Property Taxes, Insurance, and Maintenance Costs: Monthly expenses for taxes, insurance, and ongoing property maintenance.

-

Closing Costs: One-time costs involved in purchasing the property, such as agent fees, legal fees, and administrative costs.

Once you’ve entered these details, click “Calculate” and see the results in seconds!

💡 Why Use This Calculator?

This tool removes the guesswork from real estate investment analysis. By providing clear and immediate financial insights, you can:

-

Assess Property Profitability: Know if the property will generate positive cash flow and whether the potential return on investment justifies the initial purchase.

-

Make Smarter Decisions: This tool gives you a comprehensive understanding of the long-term costs and benefits associated with each property, helping you make more informed, data-driven investment decisions.

-

Compare Multiple Properties: Easily compare different properties by plugging in varying details for each one and instantly viewing their financial performance side-by-side.

Whether you’re a first-time investor, a seasoned property owner, or simply exploring rental properties as a potential source of income, this tool helps you make confident and informed decisions that align with your financial goals.

🚀 Start Calculating Your Investment Today!

With the Rental Property Investment Calculator, you can confidently assess and optimize your investments in real estate. It’s fast, easy to use, and available at your fingertips — making it an essential tool for anyone serious about real estate investing.