Rent vs Buy Calculator: Make an Informed Decision for Buying vs Renting a Home

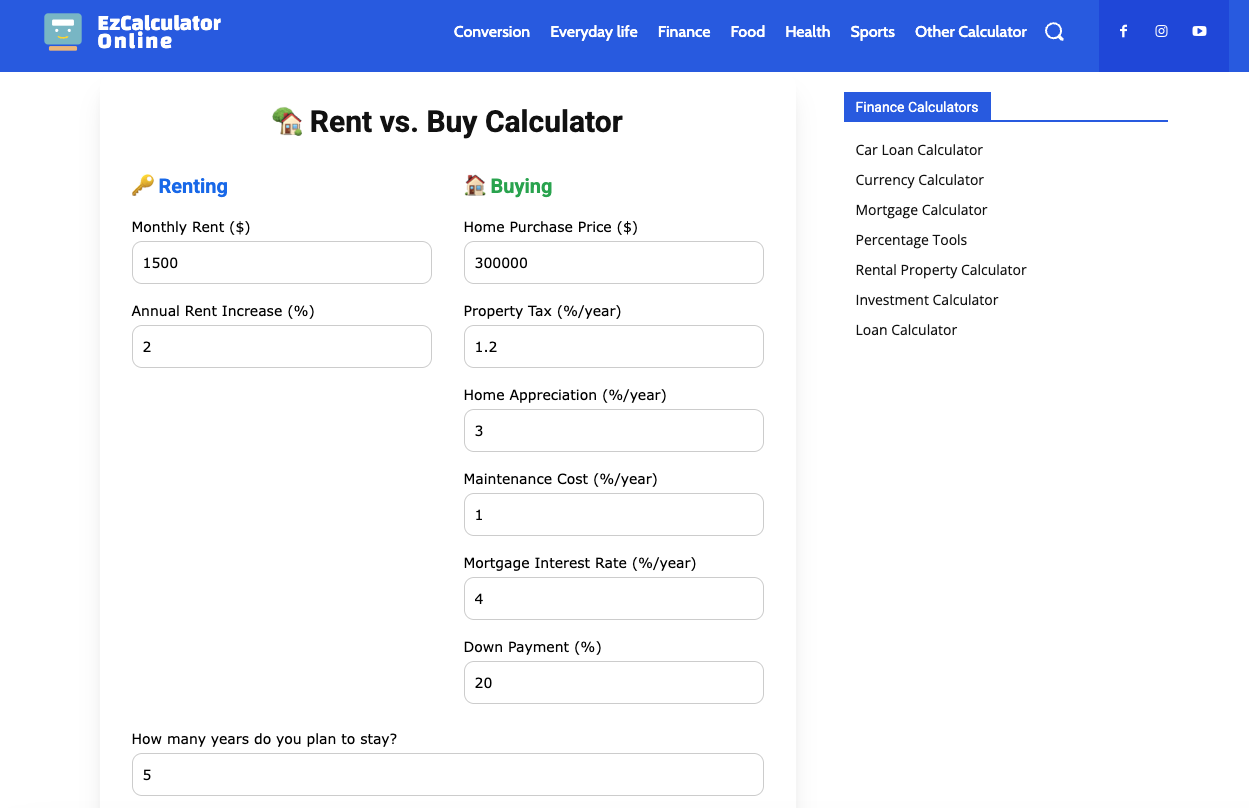

Are you unsure whether to rent or buy a home? The Rent vs. Buy Calculator helps you make a smarter decision by comparing the costs of renting versus buying a home over a specific period of time.

This tool provides:

-

Renting Costs: See the total rent cost over the time period you plan to stay.

-

Buying Costs: Calculate the total cost of buying a home, including down payment, mortgage payments, property tax, maintenance costs, and more.

-

Financial Benefit Calculation: Compare the costs and benefits of buying versus renting, helping you clearly see which option may be more financially beneficial. The tool calculates the net difference between buying a home and renting, offering a recommendation based on your results.

-

Visual Graphs: The tool also provides visual graphs to compare renting vs. buying costs over time, making it easy to visualize your expenses.

How to Use the Rent vs. Buy Calculator:

To use the tool accurately, enter the following information:

-

Renting Information:

-

Monthly Rent ($): Enter the amount you currently pay per month for rent.

-

Annual Rent Increase (%): Enter the expected annual rent increase rate. For example, if your rent is expected to increase by 3% each year, enter 3 in this field.

-

-

Buying Information:

-

Home Purchase Price ($): Enter the price of the home you’re considering buying.

-

Property Tax (%/year): Enter the annual property tax rate. For example, if the property tax is 1.2% annually, enter 1.2 in this field.

-

Home Appreciation (%/year): Enter the expected annual appreciation rate of the home’s value. For example, if the home is expected to appreciate by 5% annually, enter 5.

-

Maintenance Cost (%/year): Enter the annual maintenance cost rate for the home as a percentage of the home’s value. For example, if the maintenance cost is 1% annually, enter 1.

-

Mortgage Interest Rate (%/year): Enter the annual interest rate for the mortgage.

-

Down Payment (%): Enter the percentage of the home price that you’ll be paying upfront. For example, if you’re making a 20% down payment, enter 20 in this field.

-

-

How many years do you plan to stay?

-

How many years do you plan to stay?: Enter the number of years you plan to live in the house. This helps the tool calculate total costs over that period.

-

Results and Recommendations:

-

Renting Summary: The total cost of renting for the number of years you plan to stay.

-

Buying Summary: The total cost of buying the home, including down payment, mortgage payments, property tax, maintenance costs, and mortgage interest.

-

Net Gain if Buying vs Renting: The financial difference between buying and renting. If the result is positive, buying may be more beneficial; if negative, renting might be the better option.

-

Graph: A graph will visualize the comparison of renting vs. buying costs over time, making it easier to understand the cost differences.

Try the Rent vs Buy Calculator now to get a clearer view of your financial situation and make the best decision for your future!